The optimism behind UK retail/leisure data

Let’s face it, when retail property stats make the headlines it’s rarely good news, even when the messages are encouraging. So, P-THREE has teamed up with our friends at the Local Data Company to examine the latest data and suggest what the trends really mean for retail property. We have based our commentary on LDC’s H1 2023 Retail and Leisure Trends Analysis report that was launched at their annual Retail Summit hosted in partnership with NatWest Business in the autumn.

We think this represents a structural shift in the retail market, with the repositioning that started before (and was exacerbated by) Covid finally stabilising. In our view, this suggests that by 2025 retail property will be unequivocally moving forward.

We thought it would be useful to first consider the retail/leisure market in its totality. At first glance, the statistics appear gloomy, with the overall vacancy rate creeping up to 13.9% (from 13.8%) in the first half of the year. But when we approach the same topic from a different angle – the total number of openings/closures – although more units closed than opened, we are heartened that retail openings are at their second-highest recorded level since H1 2014.

We think this represents a structural shift in the retail market, with the repositioning that started before (and was exacerbated by) Covid finally stabilising. In our view, this suggests that by 2025 retail property will be unequivocally moving forward.

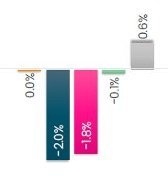

Looking at openings/closures in more detail, we were interested to see how the net change (total openings minus closures) related to the location of the property, in particular High Streets, shopping centres and retail parks. Starting with High Streets, net change dipped slightly in H1 2023 after a positive reading the previous year. Independents (whose natural home is on the High Street) were particularly hard hit. As LDC points out, hair salons have faced rocketing energy costs, with many seeing no alternative other than closure. And growing competition in the chemists/toiletries sectors resulted in the closure of all 237 Lloyds Pharmacy concessions located in Sainsbury’s supermarkets.

The P-THREE experience of individual High Streets varies dramatically by geographic location. The data suggests that the long period of readjustment is slowing. Looking forwards, we know of winning High Streets (such as Solihull, Southampton and Sutton) which have clearly identified their purpose, often by focusing on their local economy and by diversifying into residential, workspace and other property types. We note that High Streets in major conurbations are thriving, again often as a result of tapping into local economic growth and the creation of F-hubs that build community cohesion. As we pointed out in a recent P-THREE Perspectives piece there are multiple opportunities for High Streets (including those which are struggling) to adopt winning strategies.

Overall opening/closures in shopping centres saw a relatively minor fall in H1 2023 compared to the previous year with legacy effects (especially the large voids caused by the closure of department stores and the impacts of Covid) tailing off. This is confirmed by the UK shopping centre vacancy rate dropping to 17.8% in H1 2023 from a peak of 19.4% two years previously.

Our day to day experience of prime out of town destination shopping centres (for example, The Trafford Centre, Lakeside and Meadowhall) is overwhelmingly positive, with strong occupational demand and operators upsizing to take advantage of rebased rental levels. We suggest that some city centre locations, including St James Quarter Edinburgh, Bullring Birmingham and Liverpool ONE, should be placed in this super-prime category. These ‘super hubs’ have a strong entertainment focus and highly curated occupational mix and we expect them to perform increasingly well for the foreseeable future. We think prime centres will be strengthened by demand from international retailers such as Sephora, Under Armour and New Balance as we noted at this year’s Completely Retail Marketplace, as well as former online retailers moving into bricks and mortar locations, such as Sosandar, RIXO and Lounge. Prime centres are experiencing further bolstering as the tenant mix diversifies with the arrival of leisure and restaurant operators.

The undoubted darling of the retail sector right now is retail parks and these were responsible for the only positive net change in units in H1 2023, rising by 0.6%. Many of the most active occupier sectors in these out of town locations are focussed on satisfying predominantly local audiences, including supermarkets, convenience stores and takeaway food outlets.

Hugely popular with consumers, there is no question that demand for retail park space will outstrip supply. However… although this should lead to rental growth, and we expect this to happen at retail parks ahead of significant rental movements in shopping centres or High Street locations, the lack of voids will not be welcomed by some investors as these could stunt further rental increases.

As we can see, although the statistics for H1 2023 might initially appear to be slightly discouraging, there are an increasing number of locations that are bucking the trend, which is why our overall outlook is increasingly optimistic. We are very clear that while generalisations are helpful in ascertaining broad trends and directions, specialist market knowledge will provide much more accurate insights, whether they are data- or agency-led.

Katie Girdwood, Local Data Company’s Senior Business Development Manager, says: “As the market continues to evolve at pace, so does the requirement of varying degrees of data. The scale and accuracy of LDC’s retail and leisure occupancy data allows us to forensically examine the market at both macro- and micro-levels, from granular detail on a specific asset or location type up to regional and national changes over several years. With ongoing market challenges and an ever-changing landscape, it’s now more important than ever to use accurate, real-time data to support both immediate and long-term strategic decision-making.”

Looking ahead into the mid-2020s, LDC openings and closures forecasts show the retail/leisure market steadily improving, with historic lows in net change figures expected in the next two years. We are encouraged by increasing investment interest (in shopping centres, in particular) and expect this confidence to result in more centres changing hands, including to investors new to the sector, such as local authorities (who purchased centres in Fareham, Buxton and Eccles in 2023). From an occupational perspective, we think that some property locations will be invigorated by acquisitive UK brands such as Frasers, Marks & Spencer and Next – the recent purchase of Fat Face by Next is a prime example. There is, of course, a question of what will happen to the units of acquired brands, but as many are situated in relatively prime locations and demand from leisure operators strong, we expect most units released to the market to be absorbed relatively quickly.

We believe that by 2025 the protracted retail market adjustment will be much improved for those locations which have been able to successfully deal with oversupply issues, and although potential impacts from economic (cost of living crisis), geo-political (global conflict) and political (a likely UK general election in 2024) sources can’t be discounted, we are confident that in those now-thriving locations the UK retail/leisure market will regain a momentum last seen in the early 2000s. We look forward to the data backing us up!

Article by P-THREE and Local Data Company